AgMarket.Net is waiting to put out the weekly video report until USDA stocks and acreage report release on Tuesday. History tells us this report could be more friendly than negative however history also shows that USDA will not make any major revisions to demand until May. Statistically we could argue that corn feed use will go up while ethanol will go down and exports (currently well behind what is needed to meet USDA estimates) will probably be unchanged until more Chinese buying before they make revisions. Obviously the length of “stay at home” advisory will have a significant impact on driving and gas/ethanol use.

Corn continues to press into long-term lows as can be seen by the chart below. If chart support fails to hold, expect a test of nearby futures towards $3. However as you can see from the chart below, that would be a buyers blue light special. To protect against a further slide buying three week short dated 340 puts is a cheap way to alleviate some risk whether it’s against futures or cash. Look at last week’s article by Brian Split for more detail.

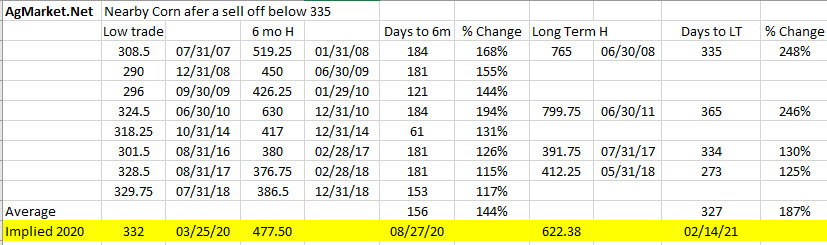

ODDS – Since 2006, there have been 16 times that the market has traded below 335 but only a handful that have closed below 335. This has resulted in eight major lows as can be seen in this chart at or below 335. 100% of the time the market will rally from these value points. The table below shows you how high the market has rallied historically from these price levels. No one knows when the low will occur or how high we will go following that. Increased acres will certainly weigh on the market as well as the cut back and ethanol, however, we would expect China buying and increased feed use around the world to have a positive impact on demand. Supply will totally be up to this year’s weather Is anyone’s guess.

Managing risk is a challenge and for more details read Matt Bennett’s weekly report.

Soybeans have a interesting story with transportation cuts in Argentina by 50% slowing exports. This is despite a national order to keep trucks moving. But mayors disregard the order and block transportation. Russia is limiting grain exports for three months through June 30th. Brazil is attempting to keep grain moving at a normal pace including feed and meat. Four other countries have cut back on exports in order to provide social stability and food supplies . These would be more small grains like rice and flour. Demand shift to US in beans is apparent and justifies the recent strength . Suspecting we’re at resistance and could sell off but support should hold. A May close above 900 would likely signal an accelerated rally.

Energy markets will continue to have a major impact on the commodity tone. Talks between Russia, Saudi Arabia and the US seemed to be at a roadblock right now. Based on one ethanol consultant break even prices for Saudi Arabia are $80.00, Russia $42, US 42 to $50 depending on process . Current prices in the 20s will not last forever but this consultant suggested another three months is possible.

USDA report tomorrow will provide some guidance to the market as well as newest concerns on COVID-19. Our staff is always available to your calls and will update our weekly research video report on Tuesday afternoon

Bill Biedermann

AgMarket.Net

815-893-7443 o

815-404-1917 c

Back