Good Morning!

I hope you’ve had a great week and a relaxing weekend. For many, harvest is either starting or about to get started. For us, we’re going to get Farm Progress Show out of the way first, enjoy Labor Day weekend then likely start nosing in. That’s the plan anyway. If the neighbors start, our plans generally get thrown out the window. The heat of this past week has really brought things along. It appears we’ll get a respite the next few days and more chances of rain. This past week we had between a half-inch and 2 ½ inches with a rain that showed up pretty much unexpectedly. Our beans certainly will benefit as things were getting dry around here. Four of us including my dad and son Toby went to Rantoul on Friday for the Heritage Tractor show. Man, we had a ton of fun watching the old equipment harvest and work ground. We go to it every year they have it, but this year Toby really started to understand some of what was going on. At 9, he’s connecting the dots, and that’s fun to watch. Keep me posted on how things are progressing around your place. mbennett@agmarket.net

I hope you’ve had a great week and a relaxing weekend. For many, harvest is either starting or about to get started. For us, we’re going to get Farm Progress Show out of the way first, enjoy Labor Day weekend then likely start nosing in. That’s the plan anyway. If the neighbors start, our plans generally get thrown out the window. The heat of this past week has really brought things along. It appears we’ll get a respite the next few days and more chances of rain. This past week we had between a half-inch and 2 ½ inches with a rain that showed up pretty much unexpectedly. Our beans certainly will benefit as things were getting dry around here. Four of us including my dad and son Toby went to Rantoul on Friday for the Heritage Tractor show. Man, we had a ton of fun watching the old equipment harvest and work ground. We go to it every year they have it, but this year Toby really started to understand some of what was going on. At 9, he’s connecting the dots, and that’s fun to watch. Keep me posted on how things are progressing around your place. mbennett@agmarket.net

The corn and bean markets saw some buying come back in this past week and posted nice gains. While crop ratings were downgraded on Monday, weather wasn’t all bad through the week. Not everyone got rain by any means, but there was plenty of rain on the radar. With some daily sales posted for both corn and beans on the morning wire, it seemed to set the stage for a supportive trade, even on those mornings we looked weak on the overnight. Heading into harvest, I struggle to get bullish, but it’s sure nice to see support for these markets. Outside markets were providing plenty of help to commodities, in my opinion anyway. The US Dollar got beat up, giving back last week’s gains. Sep closed down .384 on Friday, settling at 92.694. This was a loss of .814 on the week. The DOW rallied, settling at 35,403, up 243 points on Friday-a gain of 361 points for the week. September crude oil came to life with buyers on the move, settling up $1.32 on Friday at $68.74- a rally of $6.60 on the week.

CORN – The corn market found some buyers to show up after lackluster trade the last several sessions. On Friday, September corn settled up 5 ¼ cents at $5.58. This was three-quarters of a penny off the high and 9 ¼ off the low. Sep corn rallied 19 ¼ cents on the week. With harvest just around the corner for many of us and some already nosing out in the heart of the corn-belt, we’re about to find out just what the situation is. The hot and dry end to the summer for many has likely robbed a few bushels while bringing the corn along much quicker than many assumed we’d see. There are plenty of deals out there this year with free drying and even some pushes on basis. The grain system in the US seems much tighter than the USDA has indicated, prompting many to float ideas we’ll actually finish the marketing year at less than a billion bushels. While that may be just a number to some, it is important as the new-crop carry would be fighting an uphill battle all year if that’s the case. I like corn’s value in here, and while I don’t want to get bullish heading into harvest, I still think post-harvest there could be some good opportunities-provided we don’t get another black swan heading our way. If you are about to get started on harvest, good luck and be safe.

DEMAND – Demand this past week was mixed with overall exports a similar size and corn usage for ethanol off again. Export sales for this marketing year were down at just 6k, or 200k lower than a week ago. With new-crop sales of 684k tons, total sales were just a shade smaller on the week. Corn usage for ethanol was off four million bushels…according to the Department of Energy’s EIA report. We posted just under 94 ½ million bushels of corn usage for the week. I again see ethanol production making a big resurgence once harvest starts and more corn is around, but not all ethanol plants want to chase old bushels with the premiums it’s been taking. Posted basis levels were steady to weaker again, but talk of pushes were certainly floating around. My local basis was status-quo, with a posted bid of 60 over the Sep. In Decatur, basis was 15 cents wider at 85 over the Sep. On the river in St. Louis, basis was posted at 90 over the Sep, a dime wider than a week ago.

CASH CORN – With cash corn, it’s totally up to the producer. Cash corn is going to be new corn here in the next week. For areas that aren’t going to be harvesting soon, you may still see a big push to get a livestock feeder or ethanol plant the corn they need to get to harvest. For those areas like mine where harvest is getting started, a big push for old corn is over-and we’re now seeing just how bad they need the new corn as some are drying corn for free and/or pushing hard for early bushels. These old bushels have been a great ride, and those who were patient saw big dividends. Be cautious as to think you’ll get rewarded in the same way this next growing season.

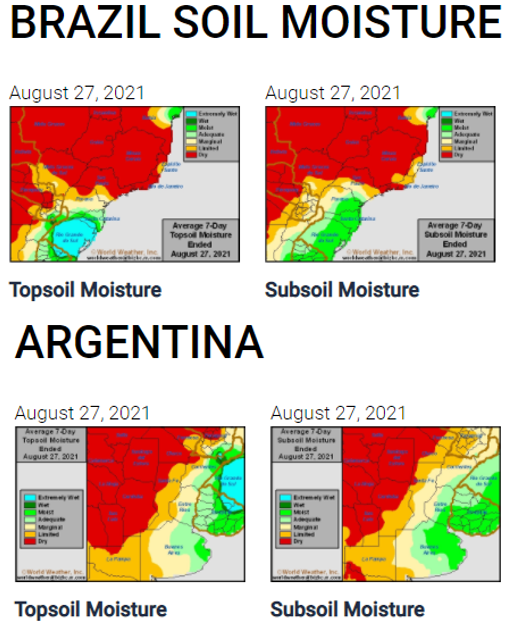

2021 CORN – December 2021 corn had a nice week as well. CZ21 closed the week at $553 ¾, up 3 cents on the day. We rallied 16 ¾ cents on the week-a nice rally as we approach harvest. This fall is going to be a fun one for those with a good crop. Those who didn’t hopefully had a good crop insurance program. For those with a crop though, it’s tough to go wrong selling across the scale at $5.50+. Can it go up from there? Of course it can. In fact, without some major issues hitting the market we aren’t thinking about, I’d assume corn will remain valuable. Given world buyers have been quite patient in their purchases in a year when Brazil didn’t raise near the crop they hoped to raise, I’m expecting corn exports to ramp up moving forward. If I were a buyer, I’d likely wait on harvest as well, but every time we see corn start to fall, buyers come in and support it. This $5.50 level in Dec sure seems like a magnet for corn. I remain content with where I’m at on sales. If my corn is better than I’m projecting, I’ll likely sell some more across the scale, but storing a third or so of my crop is likely what I’ll see happen. I think we could see fireworks again this year, especially if La Nina stays in place-as we know how bad that turned out for Brazil…and don’t go to sleep on how dry South America is heading into their next growing season. Continue to keep an eye on Dec22. We saw good buying come in this week and Dec22 settled at $5.14 ½. Be cautious as to buy all your inputs and gamble on ’22 corn prices…a person needs to think long and hard about strategy on both high-priced inputs and corn prices that are also historically high. Let me know if we can be of assistance. As I’ve talked about many times on here, a great way to track profit margins is with one of the tools me and my team have put together. You can use the profitability calculator from the AgMarket app. https://www.agmarket.app/app/

What To Watch For –

For 2020, 100% sold averaging $4.75 (not including re-ownership gains) ***must consider local basis. For ’21, 20% sold at $4.10, 10% at $4.39, $5, $6.35, $6.05 & $5.60 **of APH

For ’22, we sold 5% at $5.15 basis Dec22 – Strategies I’ve employed or considered.

Straight hedge Dec21@ $4.05, $4.14, $4.39, $5, $6.35, $6.05, $5.60 – 10% of APH on each sale *Expectations for above-APH yield lead me to believe I’m(at most)60% on actual production

*Bought May $3.80/4.40 c spread & sold March SD $4.10 c for 8 cents-sold for 12 cents

*Bought July $4.20/5.20 call spread & sold $3.70 put for 12 cents-sold for 69 cents

*Bought March $4.30/5.10 c spread and sold March SD $4.30 c-12 cents-sold for 49 cents

*Bought May SD $4.30 calls at 11 cents & sold for $1.20

Bought Dec $4.50/3.90 p spread & sold $5.70 call for 12 cents 10% of APH

*Bought Aug SD $5.75 call at 30 cents & sold at 9 cents

Straight hedge Dec22 – 5% at $5.15

**lifted these positions**

BEANS – The bean market was also in rally mode this past week. To close the week, September beans settled at $13.59 ¼, down 8 ¼ cents. This was 9 cents off the high and 35 ¼ off the low. September rallied 66 cents on the week! This bean market saw another 1% drop on crop conditions on Monday, but my guess is the crop has been somewhat bolstered by some rain around the corn-belt. While some in the market seem to think this crop is a sub-50-bushel crop, it seems to me the really good beans in those areas where we’ve seen rain could be as good as ever, possibly dragging the national yield closer to a 51 or 52-type yield. Even at that, demand is likely to remain strong, negating a bigger crop enough we wouldn’t have a cumbersome carry-out. While I’m more friendly to corn on a world/demand/US situation, there’s no doubt beans are tight in the US. World demand is strong, evidenced of late with great new-crop export sales from the US. If we had seen a poor crop out of Brazil on beans like we did corn, this market would be extremely explosive-and it sure could IF we have any level of crop failure in Brazil this coming year. For now, these prices are quite profitable and should be protected in my opinion. Locking in a worst-case scenario is great business, especially with profit margins like these on the table.

DEMAND – Soybean export sales were strong for beans this past week. Net sales of 75k gave us a small increase versus last week. 1.75m tons in sales were posted for new-crop, so overall sales were around 400k lower than a week ago but still quite large. We have slowed down some on the new-crop business on the morning wires but still seeing several-so I’d assume sales will continue to be solid. Basis wasn’t doing much this past week. Local bids for me were posted at 15 cents over the Nov-status-quo on the week. Decatur’s basis for cash beans was 40 over the Nov-also status-quo. On the river, basis is 60 over the Nov, which widened a dime on the week.

CASH BEANS – Cash beans had a good week for the first time in a while. For old beans, there are very few of them around-even fewer than we see on old-crop corn. I don’t have much good intel on old beans, but it’s a similar story to corn. Old beans are new beans within a few days. For this column that will be the case after this week. Given many producers are getting started on corn and beans are coming fast, new beans will be delivered within a few days. For those with old beans, as with corn, good job being patient on the ’20 crop-it was a wise decision. A person can’t hold onto them forever though, so make a plan and carry it out.

2021 BEANS – November 2021 beans had a good week as well. Nov21 settled the week at $13.23 ¼, down 3 cents on Friday. We rallied 32 ½ cents on the week. The bean situation is certainly hard to figure out. While the bean crop is likely a solid yield, whether it’s approaching record or not isn’t as much of a topic as it had been. I think most have settled on somewhere around a 50-bushel yield-give or take a bushel or so. I personally feel like a 50+ yield is likely, but that’s just me. Given how dry we’ve been in the NW-corn-belt, there’s room to think those places will keep yields from a record, but an August rain can change a person’s fortune in a big way as well. I think of 2012 with epic drought conditions-I’d have said on August 1st our bean yield would be 25, but after a hurricane coming up to the Midwest, we had a soaking rain and ended up with beans averaging almost 50-bushels/acre. The bean genetics these days are beyond impressive, so I contend the weather has been conducive to beans possibly being a surprise to the upside on yield. Being this is a futures market, we must also understand Brazil is likely to plant a ton of beans this coming year. I want to keep my risk managed and not be susceptible to a down market, but also have some ownership of beans moving forward. IF you sell all your beans, you may consider a call or call-spread out to spring…as a weather issue in South America could blow the lid off of the market. Keeping an eye on ’22, I’m again 20% sold at $12.60 basis the Nov22. It’s tough to argue with what kind of money we can make locking in beans much above $12.00. We settled the week on ’22 at $12.67 ¼.

As always, be sure to figure break-evens when deciding whether you want to make sales. For figuring your break-evens, I recommend using either the Profitability Calculator on the AgMarket.Net Profitability App https://www.agmarket.app/app/ to help you get a handle on your budgets and to set your marketing plan for 2021 or 2022. We’d be glad to help, so be sure to reach out.

What To Watch For –

For 2021, we’re 50% protected through fall sales with calls in place.

We’re 20% hedged at $12.60 for the 2022 crop.

Strategies I’ve employed or considered.

*Bought March $10.20/11.20 c spread & sold March SD $10.50 c 11 cents-sold for a 46-cent gain

*Bought March $10.40/12.00 c spread & sold March SD $10.50 c for 21 cents-sold 81-cent gain

*Bought Nov21 $9.80/8.80 put spread & sold $11 call for 14 cents 10% exited at 52-cent loss

*Bought Nov21 $10.40/9.40 put spread & sold $11.40 call for a nickel 10% Exited at 31-cent loss

*Bought Nov21 $11.60/10.20 p spread & sold $13 call for 18 cents 20% Exited at 18-cent loss

Sold 10% of ’21 at $11.60 basis SX21, & 10% @ $12 & 20% at $12.75 & 10% at $14.35

*Bought Aug SD $12 calls for 32 cents. Sold for $1.74

Sold 20% of ’22 at $12.60 basis SX22

**Lifted these positions**

**For the strategies I talk about on here, please remember these are the tools I use for my farm. These are not recommendations but merely a way for the reader to see how I approach marketing for my operation. There are tons of good tools out there. For more information on markets, strategies and ways to set up a solid marketing plan, visit my website at https://agmarket.net

I hope you have a great week. Please let me know if I can help you in any way.

Matt

815-665-0462 – Work

@chief321 – Twitter

mbennett@AgMarket.Net – E-mail

Back